The Truth About SafetyWing: A Budget Traveller’s Experience in 20+ Countries (2025)

If you’re here to find out whether SafetyWing travel insurance is worth it for your next trip, the short answer is: absolutely. But why should you take our word for it? After a year of using SafetyWing across 20+ countries, we finally had to put it to the test during a medical emergency in Bangkok. Spoiler alert: it worked but not without a few hiccups. Here’s our honest, no-BS review.

The Good, The Bad & The Nitty-Gritty

What We Loved:

What Frustrated Us:

Best For: Budget travellers, digital nomads, and slow travellers who want simple, affordable coverage.

Skip If: You need adventure sports coverage (it can be done as an add-on) or are visiting the U.S.

Our Real Claim’s Story: A Bangkok Nightmare

What happens if I actually need to USE this insurance?

Let me set the scene: It’s the middle of the night in Bangkok, and I’m curled up in an Airbnb, clutching my right side. Sharp pain. Sweating. Panicking. I just need to make it till morning so I can book a doctor’s appointment first thing.

Sagar is on Google, searching “appendicitis symptoms,” while I’m texting a doctor friend in India. He suggests painkillers to get me through the pain, but that’s not even the real stress. The real stress is the bill. Will the insurance cover it? We’re on a budget, and if it doesn’t, this is going to hurt in more ways than one.

By morning, we’re scrambling. Two things saved us:

- SafetyWing 24/7 live chat: Sagar messaged them instantly. No bots, a real human walked us through coverage.

- Choosing a private hospital: Government hospitals were cheaper but packed. We picked Phyathai 3 Hospital based on reviews (and sheer desperation).

The Bill That Made Us Sweat

Let’s talk numbers, because this is where the panic really set in. After two CT scans (yes, the first one was “inconclusive” 🙃), multiple doctor consultations, and a mountain of meds, our first hospital visit in Bangkok totalled 41,070 THB (~1,200 USD/1,02,606 INR). The follow-up appointment added another 1,380 THB (~ 40 USD/ 3,200 INR). As it turned out, it was just a bacterial infection, not appendicitis. Phew! I was prescribed a seven-day course of antibiotics and sent on my way.

How SafetyWing Paid Out:

- Reimbursed: 990 USD(after 250 USD deductible). (as of recent updates, new policies may have no deductible at all)

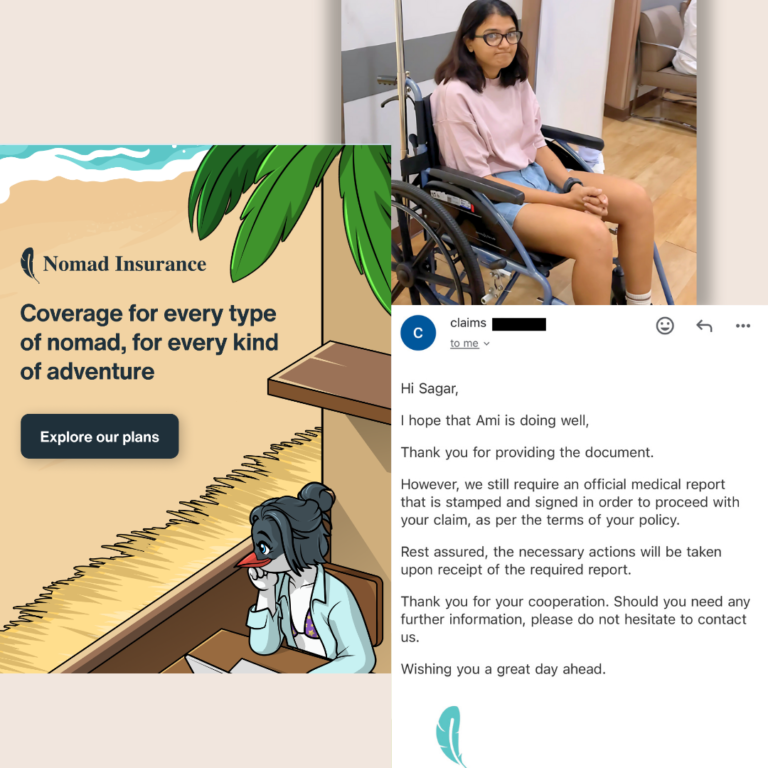

- Hiccups: The hospital forgot the doctor’s signature on our diagnosis. It took us a bit back and forth with the Safety wing team and the hospital but we got there in the end. We had a follow-up appointment lined up so that made it easier for us.

Key Takeaway

- Save every paper, even the ones that look useless.

- Private hospitals = faster care, but triple-check their paperwork.

Let me be real with you, if this claim hadn’t gone through, I’d be writing this through gritted teeth. The $1,200 we spent was 13 days’ worth of our travel budget, and losing that would’ve crushed us. What impressed me most wasn’t just the reimbursement, though; it was the human side of SafetyWing. No robotic scripts, no blame game. Just clear, empathetic emails (“I hope that Ami is doing well. Thank you for providing the document. However, we still require an official medical report that is stamped and signed in order to proceed with your claim, as per the terms of your policy.”) and a claims team that answered even our dumbest questions. But here’s the kicker: none of this works if you’re sloppy with paperwork. Before you leave any hospital, triple-check receipts for signatures, stamps, and itemised costs. Treat those papers like gold. Do that, and SafetyWing’s got your back.

Pro tip – Please read all policy documents and terms and conditions carefully before signing up. While writing this article, we noticed that the website states there are no deductibles on any of their plans. However, our policy originally showed a $250 deductible. When we reached out for clarification, we learned that the policy had changed just a few days after our purchase, meaning all new customers now have no deductibles. The lesson? Insurance providers tweak terms frequently, and changes rarely apply retroactively. Always check for policy updates, and if you hear about better terms, ask if renewing early could lock them in. A 5-minute call to their support team might save you hundreds.

What is SafetyWing Nomad Insurance?

SafetyWing Nomad Insurance is a practical, budget-friendly travel medical plan tailored for digital nomads, short-term and long-term travellers, and remote workers.

Essential plan priced at approximately 56 USD per month (for travellers aged 18−39). It covers essentials like medical expenses (up to USD 250,000), travel delays, and lost luggage. While it excludes pre-existing conditions and high-risk activities like adventure sports, its flexibility stands out; you can purchase or renew coverage even after your trip has started.

A unique perk is the 30 days of home country coverage included every 90 days, perfect for quick visits back to New Zealand or other home bases. Claims work on a reimbursement basis (you pay upfront and file later) for outpatient services with a $250 deductible per injury or illness.

The Complete Plan (priced higher) includes everything in Essential plus comprehensive health benefits like routine checkups, dental care, mental health services, and specialist visits, perfect for digital nomads prioritising preventive care.

Always verify the latest details directly on their official website, as terms and pricing can evolve.

How to File a Claim (Without Losing Your Mind)

- Save Every Receipt: Itemised bills, prescriptions, and even taxi receipts to the hospital.

- Submit via Portal: Upload PDFs (no blurry phone pics).

- Expect Back-and-Forth: Hospitals will mess up paperwork. Stay patient.

- Wait 5-10 Days: We got reimbursed in 48 hours post-approval

FAQs: What Other Travellers Ask

1. How much does SafetyWing insurance cost?

SafetyWing operates on a subscription-based model, with pricing depending on factors like age and coverage options. As of now, plans start at around $56 per month for travellers under 40.

2. Does SafetyWing cover COVID-19?

Yes, SafetyWing covers COVID-19-related medical expenses as long as you did not contract the virus before your policy started. However, quarantine costs and preventive testing may not be covered.

3. Does SafetyWing cover pre-existing conditions?

SafetyWing does not cover most pre-existing conditions, though it may provide limited coverage for acute onset of pre-existing conditions. Always check the latest policy details for specifics.

4. How does SafetyWing’s deductible work?

SafetyWing used to have a $250 deductible, but as of recent updates, new policies may have no deductible at all. Always check your policy details for the latest terms.

5. Does SafetyWing work in every country?

SafetyWing covers you in most countries worldwide, except for North Korea, Cuba, Iran, Syria, and Venezuela. Coverage in the U.S. is optional and costs extra.

6. Can I buy SafetyWing insurance while already travelling?

Yes! Unlike many traditional insurance providers, SafetyWing allows you to purchase coverage even if you’re already abroad.

7. Is SafetyWing worth it?

Based on our experience, SafetyWing is a great option for budget-conscious travellers who primarily want medical coverage. While it’s not perfect, it provides peace of mind during emergencies.

Our Essential Travel Gear

CamelBak eddy+ Water Filter Water Bottle by LifeStraw Integrated 2-Stage Filter Straw

This one purchase has truly transformed our travels. After visiting 20+ countries, we never had to worry about staying hydrated because this stainless steel water bottle has our back. It’s leak-proof, so you can toss it in your bag without a second thought!

Travel Insurance

Make sure to research a solid travel insurance policy before jetting off to any country. We’ve been with SafetyWing since the beginning of our journey, and they’ve provided top-notch customer service. Based on our experience, we can confidently recommend them!

eSIM

This has been a game-changer for us! When we started our 625-day adventure, I was initially overwhelmed by the pricing and limited data options. But switching to eSIM while in Istanbul has been a lifesaver! It offers instant connectivity as soon as you land in a new country. Roaming and local SIMs can be tricky, but eSIMs are seamless and super easy to install before you even arrive. We’ve tried both Eskimo and Airalo and recommend them! If you purchase through our link, we get a small commission at no extra cost to you, and we’d really appreciate the support!

Carry-On luggage

Seriously, this bag feels bottomless! It fits so much stuff, and I’m amazed every time I pack. We initially bought one for Sagar for our Japan trip last November, and after seeing how much he loved the design and pocket accessibility, I just had to get one too! If you’re after a stylish, long-lasting bag, this is it. It’s a bit pricey, but after using it daily for the past seven months, it’s been worth every penny.

Wise Card

What did we do before this card? It’s been a blessing! Transferring money is super easy with minimal fees, and the user-friendliness is next level. Highly recommend it!

Some links in this post are affiliate links, which means we may earn a small commission if you make a purchase, at no extra cost to you. It helps support our work and keeps this blog going.